Over the past two years, the conversation around Gen AI platforms (ChatGPT, Perplexity, etc.) in commerce has been polarizing.

On one side: Fear. Will AI disintermediate brands? Will it steal traffic? Will it replace shopping as we know it?

On the other side: Hype. Consumers quickly signed up. Today, ChatGPT has 800 million users, with 20 million paying. We expect it to do everything. Instantly. Find me gifts, compare these beauty products, tell me what to make for dinner, plan my vacation, and above all else – find the best price!

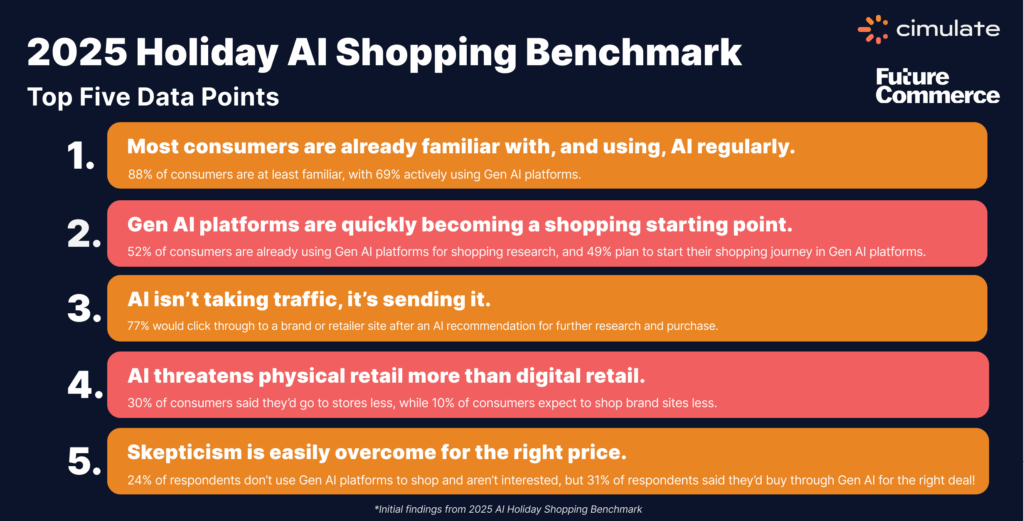

Reality exists in the gray area between these polarizing views. That’s where the most interesting signals live and why Cimulate sponsored research with Future Commerce to assess consumer intent to leverage Gen AI platforms for holiday shopping. The first phase of 1,000 consumer survey is complete, and here’s the exec summary of the results, with a deeper analysis below:

Gen AI is quickly becoming the front door to commerce, but not the checkout lane. To earn high intent traffic through a reshaped funnel, retailers & brands need to be discoverable in the platforms during research, inspiration, and price comparison. They need to earn this new high intent traffic through content + agentic commerce strategy.

Check out this CNBC article which includes some of Pacsun’s strategy Cimulate is partnering with them on. Shirely Gao, Pacsun’s chief digital and information officer compared the old way to pay for traffic vs the new way to earn it, “You pay somebody and you spend money, you get yourself listed on top,” said Shirley Gao, the chief digital and information officer at PacSun. “Now [with AI], there’s no way you can pay anybody. This is very authentic.”

Lastly, it appears to be a very real scenario that AI’s “killer feature” may become economic efficiency, so having a competitive pricing strategy is as important as ever.

Below is a deeper dive on the most salient points and what it means for brands & retailers.

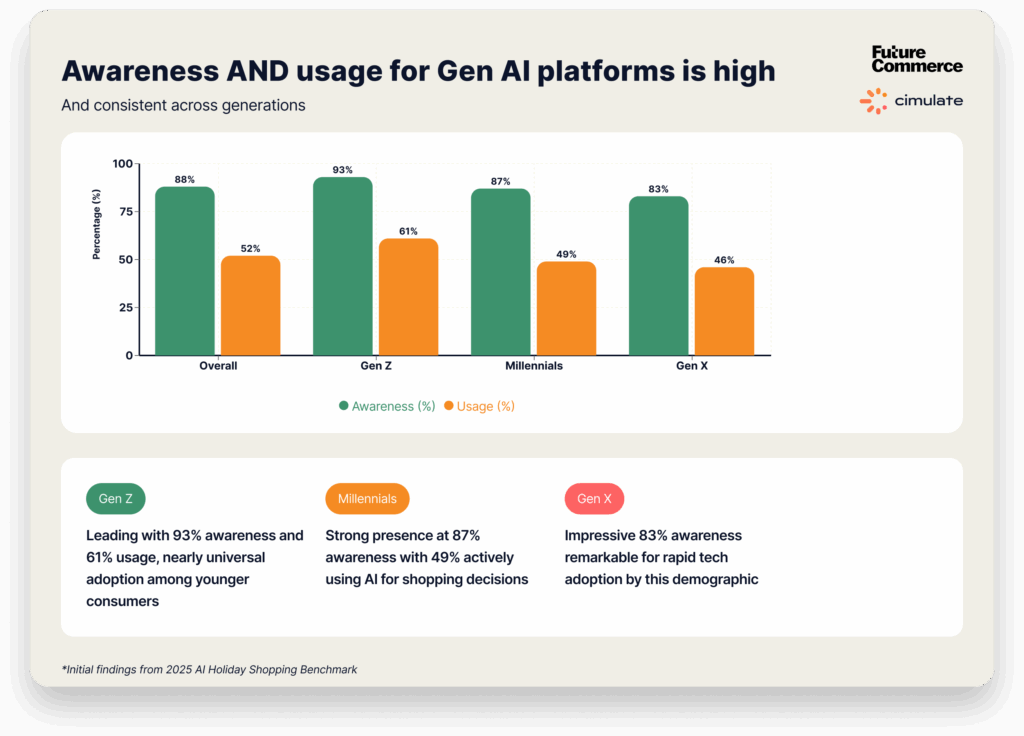

The data: 88% of respondents have at least heard of them if not used them, and 52% have already used the platforms to research and make purchases.

Unsurprisingly, this data has variations across generations with Gen Z almost completely aware (93%), Millennials slightly less (87%), and Gen X least aware (83%) which is still remarkably high for tech that didn’t exist three years ago. The trend continues when asked if they’ve used the platforms to shop with Gen Z at 61%, Millennials at 49%, and Gen X at 46%.

What it means: Gen AI platforms will become a stop in most consumer shopping journeys, with mass adoption within a handful of years.

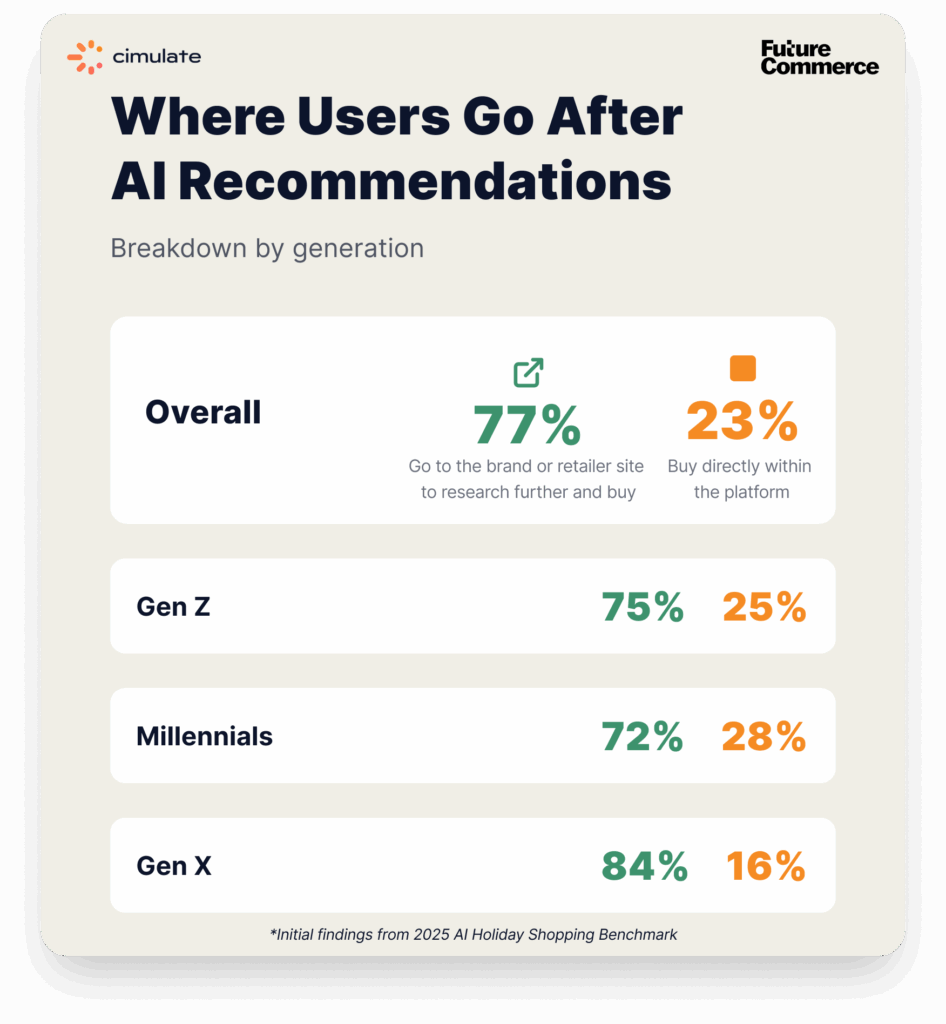

The data: When a Gen AI platform makes a recommendation, 77% of respondents are more likely to go to the brand or retailer website for further research or purchase.

When looking across generations,75% of Gen Z were more likely to go to the brand/retailer site, 72% of Millennials, and 84% of Gen X. This is the vast majority of respondents. However, on the flip side, 23% of all respondents are more likely to buy directly within the Gen AI platform, which is pretty astounding. Millennials were interestingly on the highest side with 28% willing to buy directly within the platform.

What it means: While paid Google traffic is definitely reduced for brands and retailers, the new organic traffic to earn is with the Gen AI platforms. It’s clear that the awareness and usage is high, including for shopping, and that the majority of consumers intend to follow recommendations to the brand or retailer site. These buyers build purchase confidence by conducting research within Gen AI platforms, and should be viewed as extremely high intent. Another way to think about this is the funnel is reshaped with less direct volume at the top for brand and retailer sites, but for the increased portion of top of funnel traffic coming from answer engines, the purchase intent is extremely high and they are ripe for conversion.

The data: 48% (497 respondents) have not yet used Gen AI platforms for shopping. 40% of that segment cited that they don’t think they’re safe/secure to use, or that they don’t trust them to provide accurate and unbiased information.

The generational break on this topic is very interesting. Out of Gen Z respondents that haven’t yet used Gen AI platforms for shopping, 42% cited trust/accuracy concerns, the second response category (38%) preferred to shop directly with the brand, retailer, or marketplace; it’s not trust. Followed by (20%) who don’t know which Gen AI platform is best for shopping. Millennials & Gen X rated trust/accuracy a bit lower and had a higher indication to need more education to learn what platform is best, or preference to shop with the brand.

What it means: Trust is a key consideration across all age ranges, and a core reason for not leveraging Gen AI platforms for shopping yet. However, there’s a nearly equal preference to shop directly with the brand, retailer, or marketplace. Time will tell if overcoming trust barriers will erode consumers’ preference to shop with the brand, but it hasn’t happened yet.

The data: When asked “If a Gen AI platform found the best price for a product, but it was from a retailer you do not usually shop with, would you buy through the platform or go back to your preferred retailer?” 31% said they’d buy through the platform, 37% said they’d go back to their preferred retailer, and 32% aren’t sure.

40% of Gen Z were likely to buy through the Gen AI platform with a brand they don’t know, throwing their brand affinity to the wind for the right price.

What it means: People are still assessing Gen AI’s value, but price is paramount and seems to tip the scale towards using Gen AI platforms for direct purchasing experience.

The data: The top use cases for using Gen AI platforms are (1) finding the best deal/price – 34%, (2) product comparison (31%), (3) getting gift inspiration (29%). But further research on a specific product from a brand (26%) and finding the perfect gift for someone (23%) were all important. Interestingly, there were generational differences around top use case: Gen Z is inspiration; Millennial and Gen X are finding the best deal.

What it means: There is a long list of value drivers for consumers to choose from when assessing Gen AI platforms’ value in their purchase decisions. Leaders are clearly price & product comparison, and inspiration.

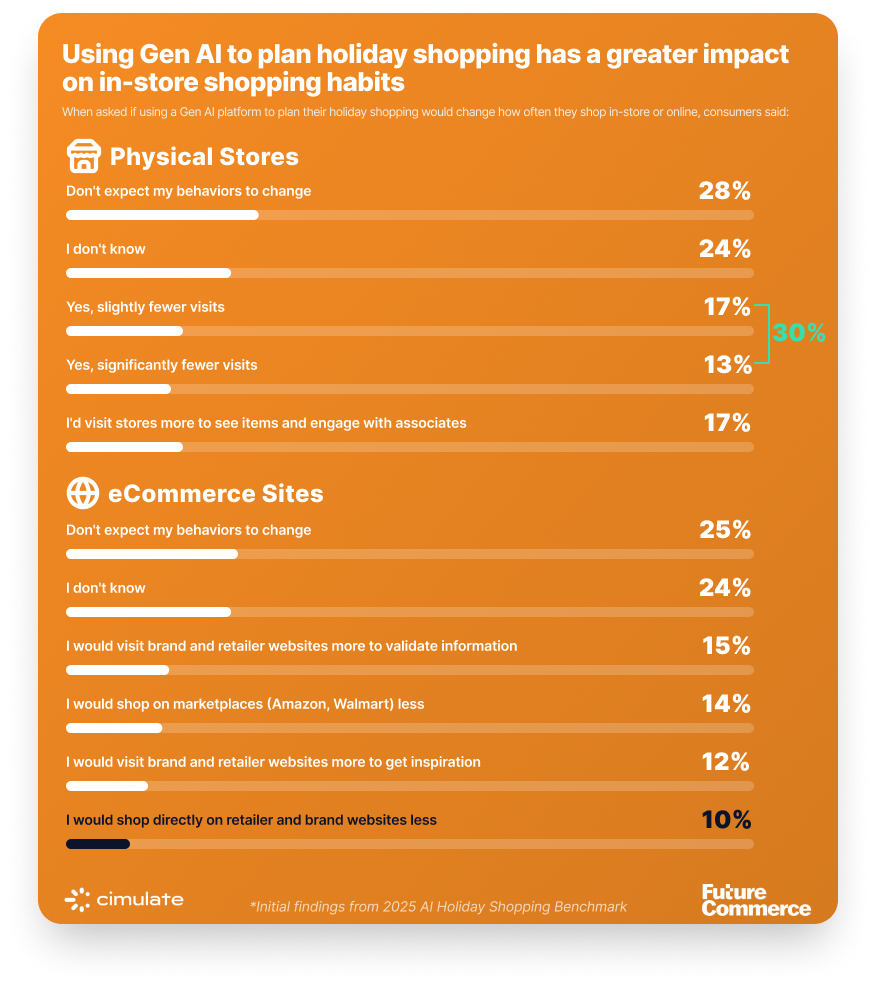

The data: An astounding 30% of respondents said they would visit stores less if they used a Gen AI platform to plan their holiday shopping, but only 10% said they would visit the brand or retailer website less. However, 14% said they would shop on marketplaces (Amazon, Walmart) less. When looking across generations, Gen X was most likely to continue showing up in-store, and Gen Z least likely.

What it means: Retailer, brand, and marketplace digital strategy is paramount. The ability to have the right product detail, authentic content, domain authority, and price competitiveness will be the winning combination for discoverability within Gen AI platforms. If a brand or retailer doesn’t refocus their digital strategy on Gen AI discoverability, they are likely to see a significant traffic & revenue impact.

Beyond my interpretation of the data, I felt relatively encouraged that although shopping behavior is forever changed by AI, there’s a fair game to be won. Consumers still prefer shopping directly with a brand or retailer and are more likely to take a referral recommendation to the brand over transacting within the AI platform. It’s also not surprising, especially during perpetual economic uncertainty and when looking at younger generations, that we see deal hunting as a leading driver of value and reason to buy direct from Gen AI platforms. Currently, AI’s killer feature is economic efficiency.

But the game to be won is through earning recommendations from Gen AI platforms. The best way to do this is deep product detail + authentic content, especially customer generated. When you combine the right pricing strategy with deep authentic authoritative content, brands will win referral traffic, and those consumers are well researched and ready to buy. Then, your digital experience needs to be on-point with modern search, conversational shopping assistant capabilities to “continue the conversation” from ChatGPT, and context-aware recommendations. It’s a level playing field for brands and retailers to fairly compete to earn this new high intent

More about the survey:

Cimulate and Future Commerce leveraged Centiment to survey 1,000 US consumers, evenly split across sex and age (Gen Z, Millennial, and Gen X). This is part one of a two-part survey to understand how consumers plan to use generative AI platforms, such as ChatGPT, Perplexity, Google’s Gemini, and other destinations to shop for gifts during the holiday season. The second survey will explore how consumers’ experiences with generative AI platforms during the holiday season will directly affect their future shopping habits and expectations.